The World Bank has attributed Kenya's high mobile call rates to delays by the Communications Authority in reducing mobile termination charges, urging the regulator to implement cost-based pricing to deliver cheaper tariffs for consumers as the current regime expires in February 2026.

In its latest Kenya Economic Update released on December 4, 2025, the World Bank noted that the local telecommunications sector has seen limited competition, leading to elevated pricing that burdens households and businesses.

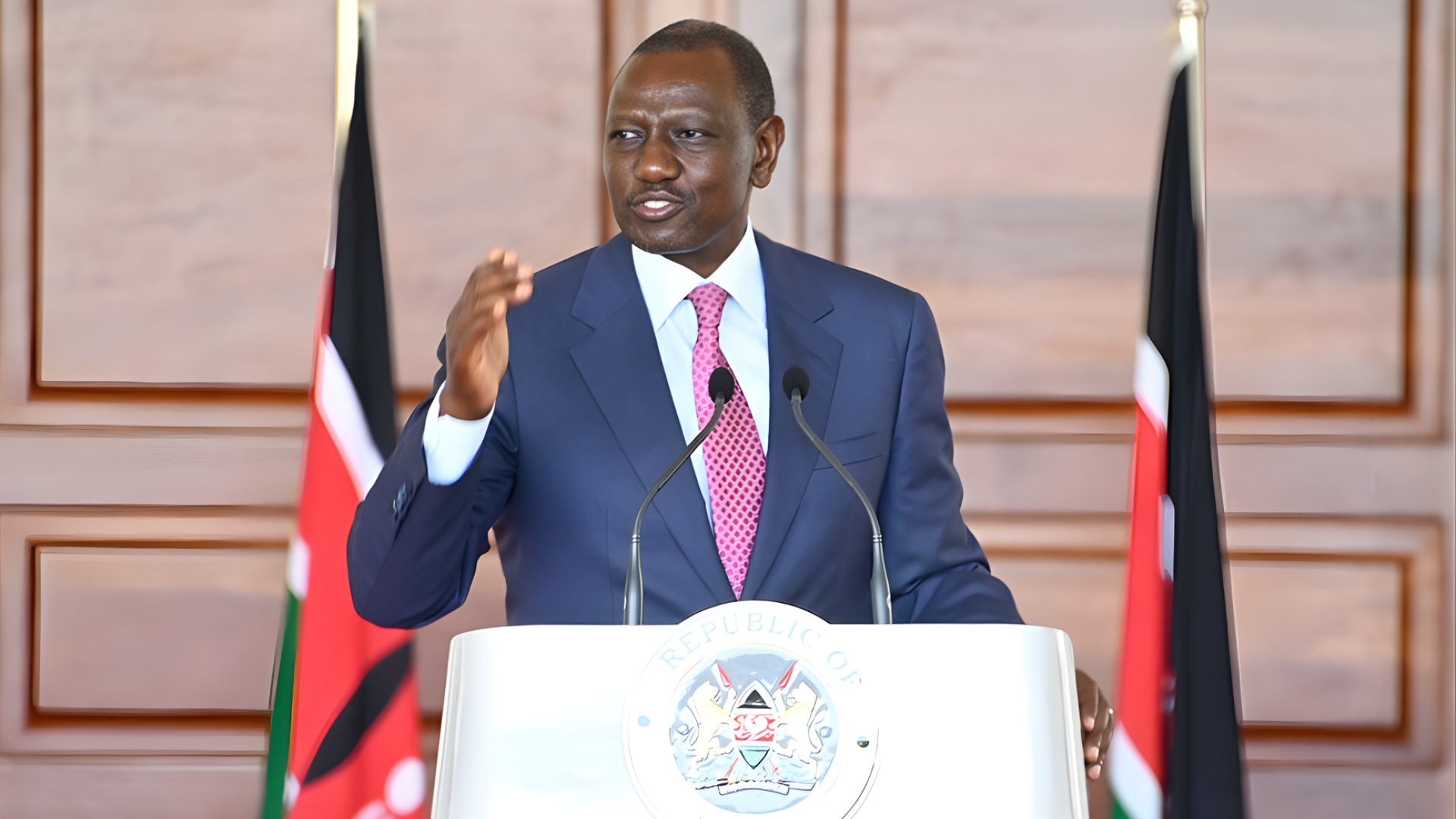

Communications Authority Director General David Mugonyi acknowledged the concerns but said the regulator is finalising a new interconnection framework. "We have conducted stakeholder consultations and are analysing submissions to ensure the new rates reflect actual costs while promoting investment," Mugonyi said.

The mobile termination rate, the fee operators charge each other for completing calls on their networks, currently stands at KSh 0.41 per minute for voice and KSh 0.05 for SMS, down from KSh 0.99 in 2021 but still above regional averages.

World Bank Senior Economist Utz Pape said the delay in further reductions has allowed operators to maintain high retail prices. "Kenya's MTRs remain 25 percent higher than Uganda's and 40 percent above Tanzania's," Pape said. "This translates to consumers paying up to 15 percent more for calls than their East African neighbours."

Consumers have long complained about the high cost of communication. In Nairobi's Kariobangi North, small business owner Beatrice Kwamboka said her monthly airtime bill of KSh 2,500 eats into her grocery profits. "If calls were cheaper, I could call more suppliers and expand my stock," Kwamboka said. "The CA promises reviews every year, but prices never drop."

The World Bank recommends adopting a pure LRIC model, where rates are based solely on the incremental cost of terminating a call, potentially slashing the voice MTR to KSh 0.15 or lower.

Safaricom Chief Executive Officer Peter Ndegwa defended the current rates as necessary for network investments. "Lower MTRs without balancing retail price controls could discourage expansion into rural areas," Ndegwa said. "We support cost-based pricing but need a phased approach."

Airtel Kenya Managing Director Ashish Malhotra agreed, noting that termination revenues fund 5G rollout. "Cheaper rates are good for consumers, but they must not compromise service quality," Malhotra said.

The CA last reviewed MTRs in 2021, reducing them from KSh 0.99 to KSh 0.41, but a planned 2024 review was postponed due to legal challenges from smaller operators.

Telkom Kenya Chief Executive Officer Mugo Kibati called for symmetry in rates. "Asymmetrical MTRs favour dominant players," Kibati said. "Cost-based pricing must be fair for all to foster competition."

The delay has broader economic implications, the World Bank report stated. High communication costs hinder digital inclusion, with 28 percent of Kenyans citing affordability as a barrier to mobile internet.

Kenya National Bureau of Statistics data shows average monthly spending on airtime and data at KSh 1,450 per household, 8 percent of urban incomes.

Consumer Federation of Kenya Chairman Stephen Mutoro urged swift action. "Kenyans are overpaying by billions annually," Mutoro said. "The CA must prioritise consumers over operator profits."

The regulator has promised a new determination by January 2026, ahead of the February expiration. "We are committed to affordable services," Mugonyi said. "The review will balance costs, competition, and consumer interests."

As February approaches, stakeholders await the CA's decision, hoping for a pricing regime that makes calls more accessible for all.