The International Monetary Fund has scheduled a staff mission to Kenya in January 2026 to continue discussions on a new funded programme, maintaining momentum on negotiations for fresh financing and debt treatment reforms.

The visit, led by Kenya's mission chief Haimanot Teferra, follows high-level talks in Washington DC last month between President William Ruto and IMF Managing Director Kristalina Georgieva, and a preliminary staff assessment in Nairobi from September 25 to October 9, 2025.

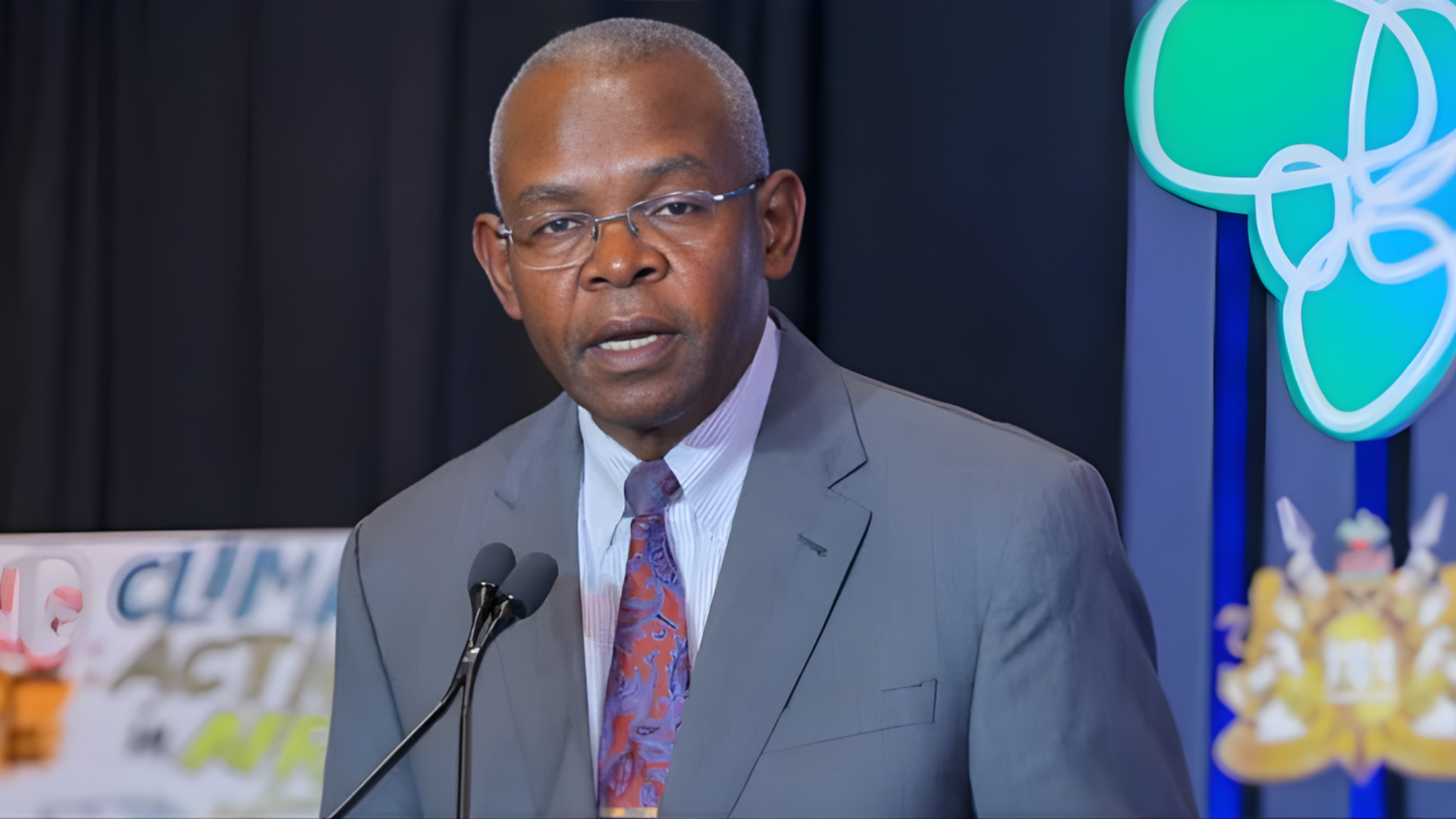

Central Bank of Kenya Governor Kamau Thugge confirmed the timeline during a press conference on December 10, 2025, emphasising that the mission will address key sticking points, including the classification of securitised government revenue as debt.

"We continue to engage with the IMF on securing a successor arrangement to the expired $3.6 billion Extended Fund Facility and Extended Credit Facility," Thugge said. "The January visit will build on the October discussions, assessing macroeconomic developments and reforms to ensure public finance sustainability."

The announcement comes as Kenya navigates a public debt burden of Sh10.5 trillion (68 percent of GDP) as of September 2025, with external debt servicing projected to consume Sh1.2 trillion in the 2025/26 fiscal year. The previous IMF programme, approved in 2021 for $3.6 billion over four years, expired in April 2025 after five reviews and an extension, providing $2.3 billion in disbursements.

Treasury Cabinet Secretary John Mbadi, who met IMF officials in Washington, said the new programme could unlock up to $1.5 billion in financing over three years, contingent on resolving disagreements over securitised debt. "Our position is that securitised revenue from special purpose vehicles like the sports fund does not constitute sovereign debt, as the risk transfers to private entities," Mbadi explained. "The IMF views it differently, classifying it as contingent liability. The January mission will finalise this analysis."

The securitised debt, totalling Sh400 billion for infrastructure like roads and housing, has been a flashpoint. Kenya argues it offloads risk, but the IMF insists on inclusion in debt metrics to maintain transparency. "Resolving this will anchor our external debt strategy and open doors to concessional financing," Mbadi added.

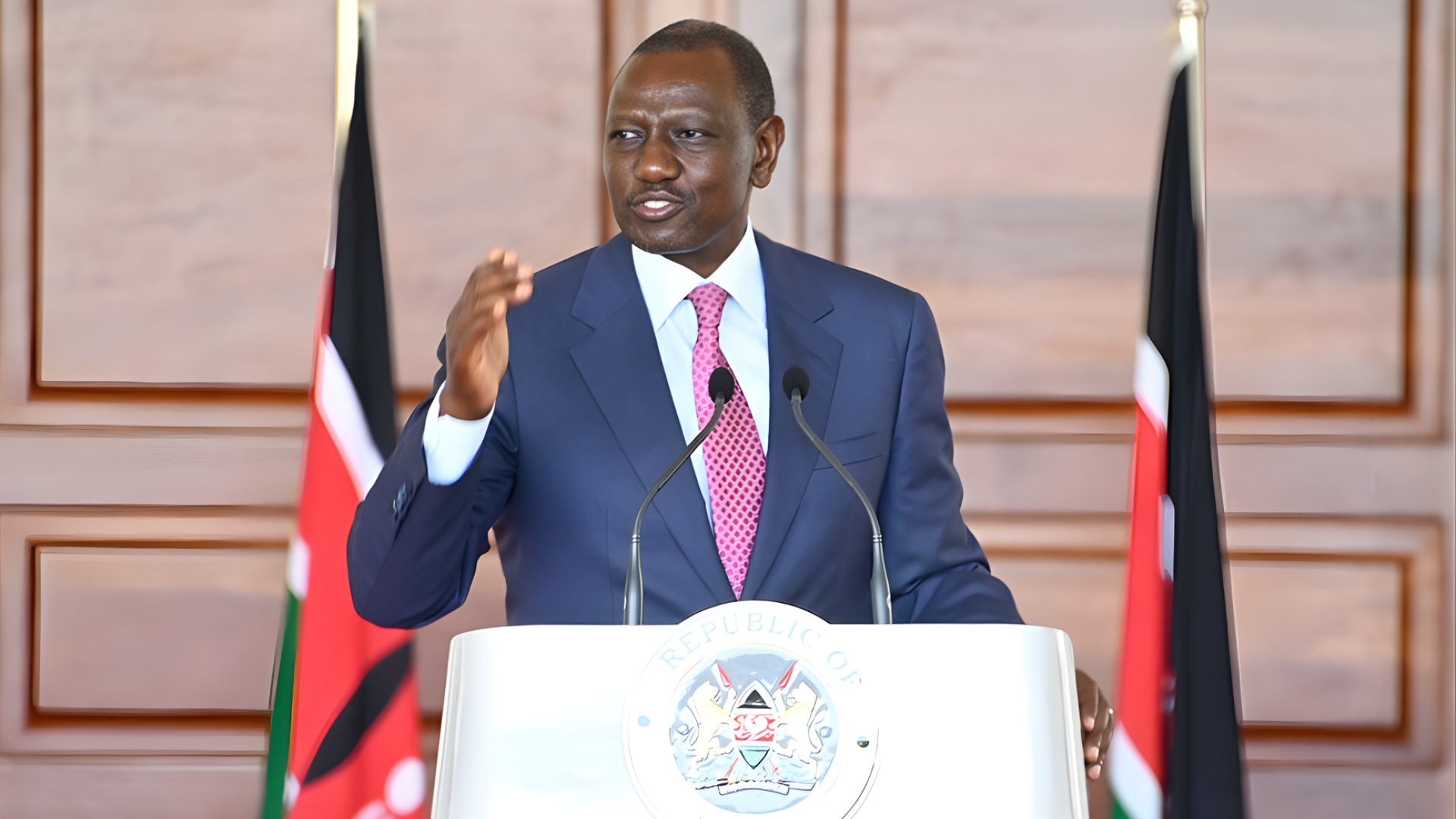

President Ruto, speaking after his Washington meeting, underscored the programme's importance for economic stability. "We are committed to reforms that enhance fiscal credibility while protecting vulnerable groups," Ruto said. "A new IMF arrangement will support our Bottom-Up Economic Transformation Agenda, ensuring sustainable growth without compromising social spending."

The IMF's October statement highlighted policy priorities: enhancing fiscal policy credibility, ensuring debt sustainability, and minimising fiscal, financial, and external risks. It praised Kenya's prudent spending execution but noted challenges from global conditions, including high interest rates and commodity volatility.

David Ndii, chairperson of the Presidential Council of Economic Advisors, has questioned the need for a new programme. "Kenya's debt trajectory is stabilising; we should focus on domestic revenue and capital markets rather than repeated IMF deals," Ndii argued in a recent op-ed. "The securitisation debate is symptomatic of over-reliance on multilateral lenders."

However, financial analysts say the programme is crucial for credibility. "A fresh IMF seal would lower borrowing costs and attract investors wary of Kenya's Sh1.4 trillion in maturities due in 2026," said Aly Khan Satchu, chief executive of Rich Management. "Without it, Eurobond yields could spike above 10 percent."

The January mission will evaluate progress on revenue mobilisation, including the digital services tax and property tax reforms, which boosted collections by 12 percent to Sh2.1 trillion in FY 2024/25. It will also assess governance improvements, such as anti-corruption measures and public procurement transparency.

IMF Resident Representative Haimanot Teferra praised Kenya's resilience. "Despite shocks, growth is projected at 5.2 percent for 2025, supported by agriculture and services," Teferra said. "The new programme would build on this, focusing on climate resilience and inclusive growth."

The 2025/26 budget, presented in June, did not factor in IMF funding, reflecting caution. Mbadi: "We prepared without it, but a deal would provide buffers against downside risks like drought or global slowdowns."

Critics, including opposition leader Raila Odinga, warn against austerity. "IMF programmes often prioritise debt over people," Odinga said. "We need financing that invests in jobs, not just repayments."

As January approaches, the mission holds promise for stability in a debt landscape where external creditors hold 52 percent of obligations.